Child dependent care tax credit information

Home » Trending » Child dependent care tax credit informationYour Child dependent care tax credit images are ready. Child dependent care tax credit are a topic that is being searched for and liked by netizens today. You can Download the Child dependent care tax credit files here. Find and Download all free vectors.

If you’re looking for child dependent care tax credit pictures information connected with to the child dependent care tax credit topic, you have come to the right blog. Our site frequently gives you hints for seeing the maximum quality video and image content, please kindly surf and locate more informative video articles and images that match your interests.

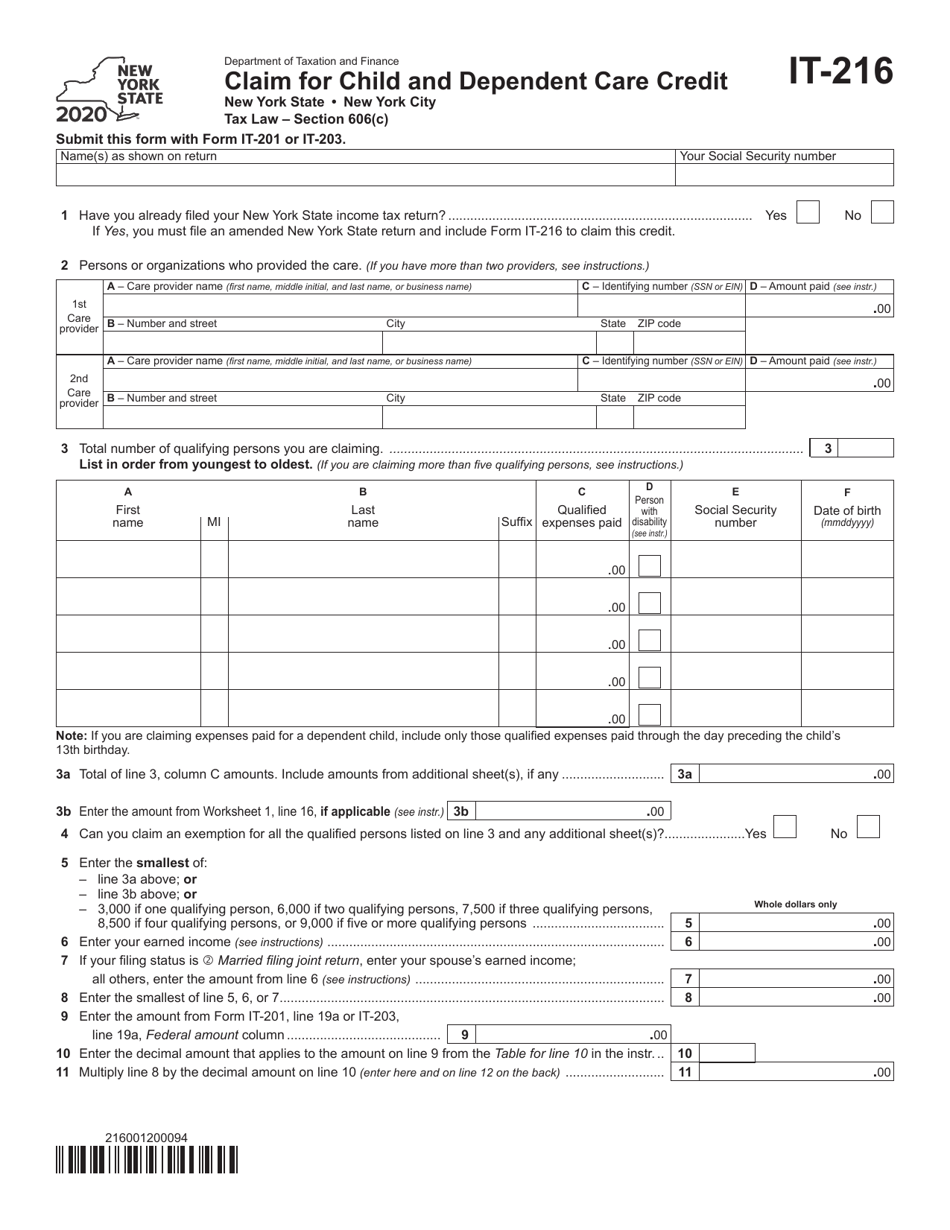

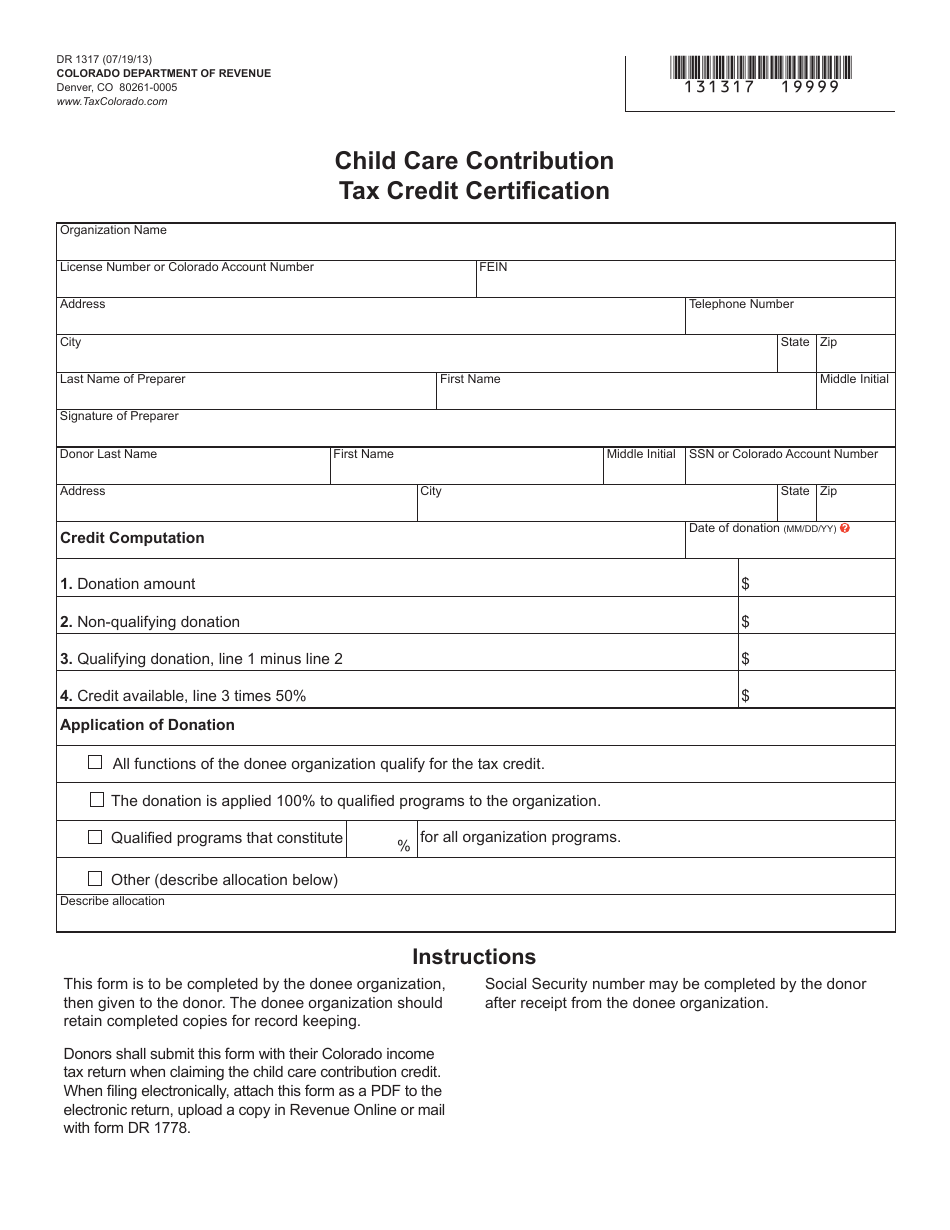

Child Dependent Care Tax Credit. The credit is calculated based on your income and a percentage of expenses that you incur for the care of qualifying persons to enable you to go to work, look for work, or attend school. The child care tax credit helps working parents pay for daycare expenses for children under 13, incapacitated spouses and qualifying adult dependents. Legislation enacted in march, 2021, expanded the credit and made the credit refundable. What is the child and dependent care tax credit if an individual paid someone to care for their child or other qualifying person so that they (and their spouse if filing jointly) could work or look for work in 2021, they may qualify for the child and dependent care expenses credit.

Dependent Care Child Tax Credit 2020 Get Credit for From maklarten.blogspot.com

Dependent Care Child Tax Credit 2020 Get Credit for From maklarten.blogspot.com

The child and dependent care tax credit helps working parents afford the cost of childcare. The child care tax credit helps working parents pay for daycare expenses for children under 13, incapacitated spouses and qualifying adult dependents. You may be able to claim the child and dependent care credit if you paid expenses for the care of a qualifying individual to enable you (and your spouse, if filing a joint return) to work or actively look for work. For tax year 2021, the maximum eligible expense for this credit is $8,000 for one child and $16,000 for two or more. The child and dependent care credit is a tax break specifically for working people to help offset the costs associated with caring for a child or dependent with disabilities. The child and dependent care credit is a credit to give some money back to families that incur expenses that enable them to work.

Generally, you may not take this credit if your filing status is married filing.

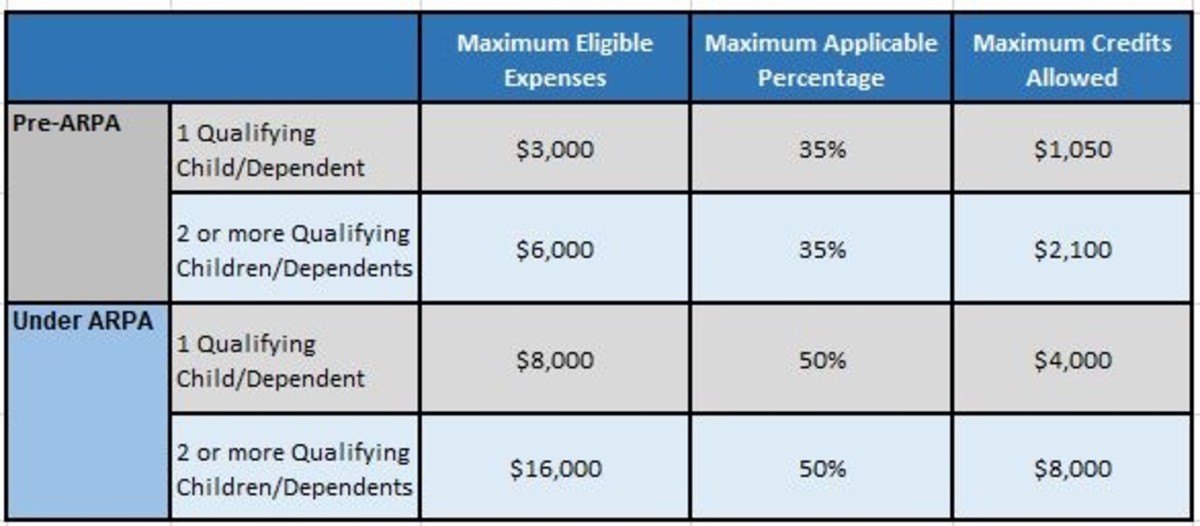

The credit comes with two key advantages: Your adjusted gross income (agi) determines how much you can claim back. In other words, families with two kids who spent at least $16,000 on day care in 2021 can get $8,000 back from the irs through the expanded tax credit. The child and dependent care tax credit is worth anywhere from 20% to 35% of qualifying care expenses. This insight summarizes the temporary change, highlighting the credit amount for 2021. Your adjusted gross income (agi) determines how much you can claim back.

Source: maklarten.blogspot.com

Source: maklarten.blogspot.com

The child and dependent care credit is a tax break specifically for working people to help offset the costs associated with caring for a child or dependent with disabilities. You will generally qualify for the child and dependent care tax credit if you meet all of the following conditions: If you are married and filing a joint tax return, your spouse must also have earned income. When calculating the dependent care tax credit, you may use up to $3,000 of dependent care expenses if you have one qualifying dependent and up to $6,000 if you have two. The child care tax credit helps working parents pay for daycare expenses for children under 13, incapacitated spouses and qualifying adult dependents.

Source: thestreet.com

Source: thestreet.com

If you are married and filing a joint tax return, your spouse must also have earned income. A tax deduction reduces the amount of. There are two major benefits of the credit: The child care tax credit helps working parents pay for daycare expenses for children under 13, incapacitated spouses and qualifying adult dependents. Your adjusted gross income (agi) determines how much you can claim back.

Source: taxpolicycenter.org

Source: taxpolicycenter.org

Legislation enacted in march, 2021, expanded the credit and made the credit refundable. The credit is calculated based on your income and a percentage of expenses that you incur for the care of qualifying persons to enable you to go to work, look for work, or attend school. Your adjusted gross income (agi) determines how much you can claim back. The child and dependent care credit lets taxpayers directly reduce their tax burden by the amount spent on child or dependent care, including day care, babysitters and related transportation. Benefits of the tax credit.

Source: moneycrashers.com

Source: moneycrashers.com

The child and dependent care credit is a tax credit that may help you pay for the care of eligible children and other dependents (qualifying persons). This is a tax credit, rather than a tax deduction. The child care tax credit helps working parents pay for daycare expenses for children under 13, incapacitated spouses and qualifying adult dependents. The child and dependent care tax credit helps working parents afford the cost of childcare. A tax deduction reduces the amount of.

Source: action.momsrising.org

Source: action.momsrising.org

You must have earned income, such as wages from a job. For tax year 2021, the maximum eligible expense for this credit is $8,000 for one child and $16,000 for two or more. Under the american rescue plan act (arpa) of 2021, allowable expenses. Families can claim up to $3,000 in dependent care expenses for one child/dependent and $6,000 for two children/dependents per year. The child and dependent care tax credit can save families up to $1,200 in 2022 when they hire a nanny or other child care provider.

Source: templateroller.com

Source: templateroller.com

The american rescue plan act of 2021 significantly increased the child and dependent care credit for 2021. 602 child and dependent care credit. Up to a total of $3,000. Rather than a tax deduction, this is a tax credit. This is a tax credit, rather than a tax deduction.

Source: moneycrashers.com

Source: moneycrashers.com

About the child and dependent care tax credit (cdctc) the cdctc applies for a child under 13 or a disabled dependent. Up to a total of $6,000. The child and dependent care credit is a credit to give some money back to families that incur expenses that enable them to work. The expenses must have been incurred before the child reached age 13. If you qualify, you can claim up to $8,000 of care expenses for one dependent or $16,000.

Source: templateroller.com

Source: templateroller.com

You can claim up to $8,000 in expenses for the care of one dependent, and up to $16,000 for the care of two or more qualifying dependents. The percentage depends on your adjusted gross income (agi). You must have earned income, such as wages from a job. Benefits of the tax credit. The child and dependent care tax credit (cdctc) is a tax credit that helps working families pay expenses for the care of children, adult dependents or an incapacitated spouse.

Source: taxpolicycenter.org

Source: taxpolicycenter.org

The child care tax credit helps working parents pay for daycare expenses for children under 13, incapacitated spouses and qualifying adult dependents. Claim your credit with h&r block Calculating the child and dependent care credit until 2020 for tax years through 2020, the dependent care credit is 20% to 35% of qualified expenses. You will generally qualify for the child and dependent care tax credit if you meet all of the following conditions: Legislation enacted in march, 2021, expanded the credit and made the credit refundable.

Source: sites.google.com

You must have earned income, such as wages from a job. Your adjusted gross income (agi) determines how much you can claim back. What is the child and dependent care tax credit if an individual paid someone to care for their child or other qualifying person so that they (and their spouse if filing jointly) could work or look for work in 2021, they may qualify for the child and dependent care expenses credit. The credit is calculated based on your income and a percentage of expenses that you incur for the care of qualifying persons to enable you to go to work, look for work, or attend school. For the purposes of this credit, the irs defines a qualifying person as:

Source: behindthenumbers.ca

Source: behindthenumbers.ca

The expenses must have been incurred before the child reached age 13. What is the child and dependent care tax credit if an individual paid someone to care for their child or other qualifying person so that they (and their spouse if filing jointly) could work or look for work in 2021, they may qualify for the child and dependent care expenses credit. The child and dependent care credit is a credit to give some money back to families that incur expenses that enable them to work. Up to a total of $6,000. The child and dependent care tax credit helps working parents afford the cost of childcare.

Source: youtube.com

Source: youtube.com

Your adjusted gross income (agi) determines how much you can claim back. For tax year 2021, the maximum eligible expense for this credit is $8,000 for one child and $16,000 for two or more. The eligibility requirements are as follows: The child and dependent care credit is a fully refundable tax credit, which means even if you don’t owe the irs any money, you can still receive the credit as a tax refund. If you qualify, you can claim up to $8,000 of care expenses for one dependent or $16,000.

Source: ffyf.org

Source: ffyf.org

The child and dependent care credit is a tax credit created to aid working parents in helping offset child care costs. What is the child and dependent care tax credit if an individual paid someone to care for their child or other qualifying person so that they (and their spouse if filing jointly) could work or look for work in 2021, they may qualify for the child and dependent care expenses credit. One of the nice things about the child and dependent care tax credit is that it does not disappear with higher incomes. The child and dependent care credit is a credit to give some money back to families that incur expenses that enable them to work. The child and dependent care credit is a tax credit created to aid working parents in helping offset child care costs.

Source: moneycrashers.com

Source: moneycrashers.com

The child and dependent care credit is a fully refundable tax credit, which means even if you don’t owe the irs any money, you can still receive the credit as a tax refund. A taxpayer�s dependent who is 12 or younger (no age limit if incapacitated) when the care is provided. About the child and dependent care tax credit (cdctc) the cdctc applies for a child under 13 or a disabled dependent. One of the nice things about the child and dependent care tax credit is that it does not disappear with higher incomes. Calculating the child and dependent care credit until 2020 for tax years through 2020, the dependent care credit is 20% to 35% of qualified expenses.

Source: tmdaccounting.com

Source: tmdaccounting.com

The child and dependent care tax credit (cdctc) is a tax credit that helps working families pay expenses for the care of children, adult dependents or an incapacitated spouse. The child and dependent care tax credit (cdctc) is a tax credit that helps working families pay expenses for the care of children, adult dependents or an incapacitated spouse. If you qualify, you can claim up to $8,000 of care expenses for one dependent or $16,000. About the child and dependent care tax credit (cdctc) the cdctc applies for a child under 13 or a disabled dependent. So while the percentage is less, this credit is designed with working families in mind, and you can still get a good amount of the expenses you pay for dependent care back in your tax refund.

Source: promisethechildren.org

Source: promisethechildren.org

Rather than a tax deduction, this is a tax credit. Tax credit for dependent, child care. One of the nice things about the child and dependent care tax credit is that it does not disappear with higher incomes. You may be able to claim the child and dependent care credit if you paid expenses for the care of a qualifying individual to enable you (and your spouse, if filing a joint return) to work or actively look for work. Prior to the american rescue plan, parents.

Source: thebalance.com

Source: thebalance.com

The child and dependent care credit is a credit to give some money back to families that incur expenses that enable them to work. You must have earned income, such as wages from a job. The child and dependent care tax credit (cdctc) is a tax credit that helps working families pay expenses for the care of children, adult dependents or an incapacitated spouse. You may be able to claim the child and dependent care credit if you paid expenses for the care of a qualifying individual to enable you (and your spouse, if filing a joint return) to work or actively look for work. For tax year 2021, the maximum eligible expense for this credit is $8,000 for one qualifying person and $16,000 for two or more.

Source: dontmesswithtaxes.com

If you are married and filing a joint tax return, your spouse must also have earned income. The child and dependent care tax credit (cdctc) can help to partially offset working families’ child care. For tax year 2021, the maximum eligible expense for this credit is $8,000 for one child and $16,000 for two or more. The child and dependent care credit is a tax break specifically for working people to help offset the costs associated with caring for a child or dependent with disabilities. Generally, you may not take this credit if your filing status is married filing.

This site is an open community for users to do submittion their favorite wallpapers on the internet, all images or pictures in this website are for personal wallpaper use only, it is stricly prohibited to use this wallpaper for commercial purposes, if you are the author and find this image is shared without your permission, please kindly raise a DMCA report to Us.

If you find this site helpful, please support us by sharing this posts to your own social media accounts like Facebook, Instagram and so on or you can also save this blog page with the title child dependent care tax credit by using Ctrl + D for devices a laptop with a Windows operating system or Command + D for laptops with an Apple operating system. If you use a smartphone, you can also use the drawer menu of the browser you are using. Whether it’s a Windows, Mac, iOS or Android operating system, you will still be able to bookmark this website.

Category

Related By Category

- Car rocker Idea

- Cars for sale myrtle beach information

- Care now fort pierce Idea

- Careen meaning Idea

- Careworks urgent care information

- Car rental statesboro ga information

- Car sense hatfield pa Idea

- Car rental owensboro ky Idea

- Car not blowing hot air information

- Car names that start with c information