Cares act colorado Idea

Home » Trend » Cares act colorado IdeaYour Cares act colorado images are available. Cares act colorado are a topic that is being searched for and liked by netizens now. You can Find and Download the Cares act colorado files here. Get all free photos.

If you’re looking for cares act colorado pictures information linked to the cares act colorado interest, you have come to the right blog. Our site always provides you with suggestions for seeing the maximum quality video and picture content, please kindly surf and locate more informative video articles and images that fit your interests.

Cares Act Colorado. Csu was granted $8.8 million in emergency grant funding in the spring of 2020 that was to be allocated directly to students in need. The cares act expired at the end of 2020. 21, 2021, colorado enacted legislation, h.b. 1 for many taxpayers, the required state addbacks resulted in a permanent disallowance of certain deductions.

The CARES Act of 2020 An Overview for Homeowners and From blog.jmdenverhomes.com

The CARES Act of 2020 An Overview for Homeowners and From blog.jmdenverhomes.com

Colorado mesa university received and additional allocation from the department of education from section 314(a)(1) of the crsaa act to provide emergency financial aid grants to students. In june and july 2020, colorado enacted legislation, promulgated a regulation and issued administrative guidance, all as part of an effort to address the state’s conformity to the internal revenue code (irc) and the federal cares act. Colorado college was the recipient of federal funding under the coronavirus aid, relief, and economic security act, also known as the cares act, which provides emergency relief funds to organizations and individuals affected by the coronavirus pandemic. The coronavirus aid, relief, and economic security act, also known as the cares act, is a $2.2 trillion economic stimulus bill passed by the 116th u.s. And (2) the amount the taxpayer was required to add back due to colorado decoupling from the cares act changes to irc section. “guidance will come,” says chris lamay.

Learn how the federal coronavirus relief bill, also known as the cares act, may affect you and your charitable goals in this prerecorded.

Section 461(i) deduction for business interest expense under i.r.c. The university of colorado denver | anschutz signed and returned the department of education’s certification and agreement acknowledging that the university will use 50 percent of the total funds received under section 18004(a)(1) of the cares act to provide emergency financial aid grants to students. Polis directed the transfer of $510 million from the state of colorado’s cares act coronavirus relief fund to cde to be. Cares act tax law changes & colorado impact 3 revised august 2021 individuals6 net operating losses net operating loss carryback provisions the cares act allowed taxpayers to carry back net operating losses arising in tax years beginning after december 31, 2017 and before january 1, 2021 to the five tax years preceding the year of the loss.7 Section 199a provided by the cares act Covid 19 rural resource guide.

Source: lexialearning.com

Source: lexialearning.com

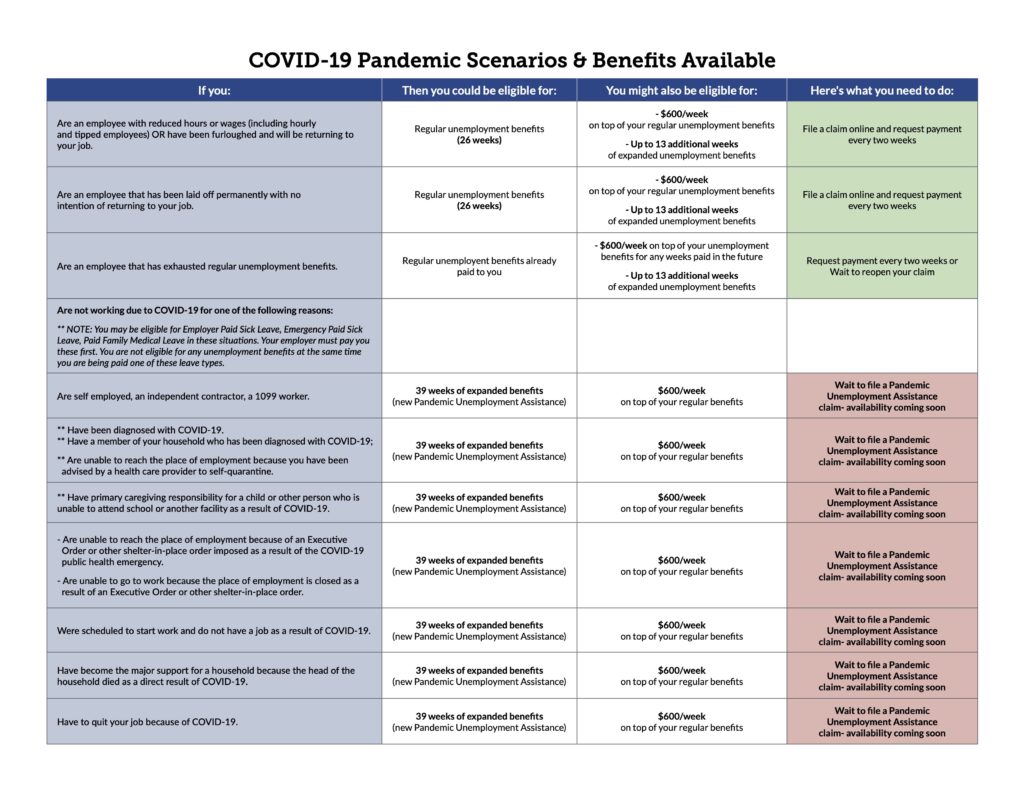

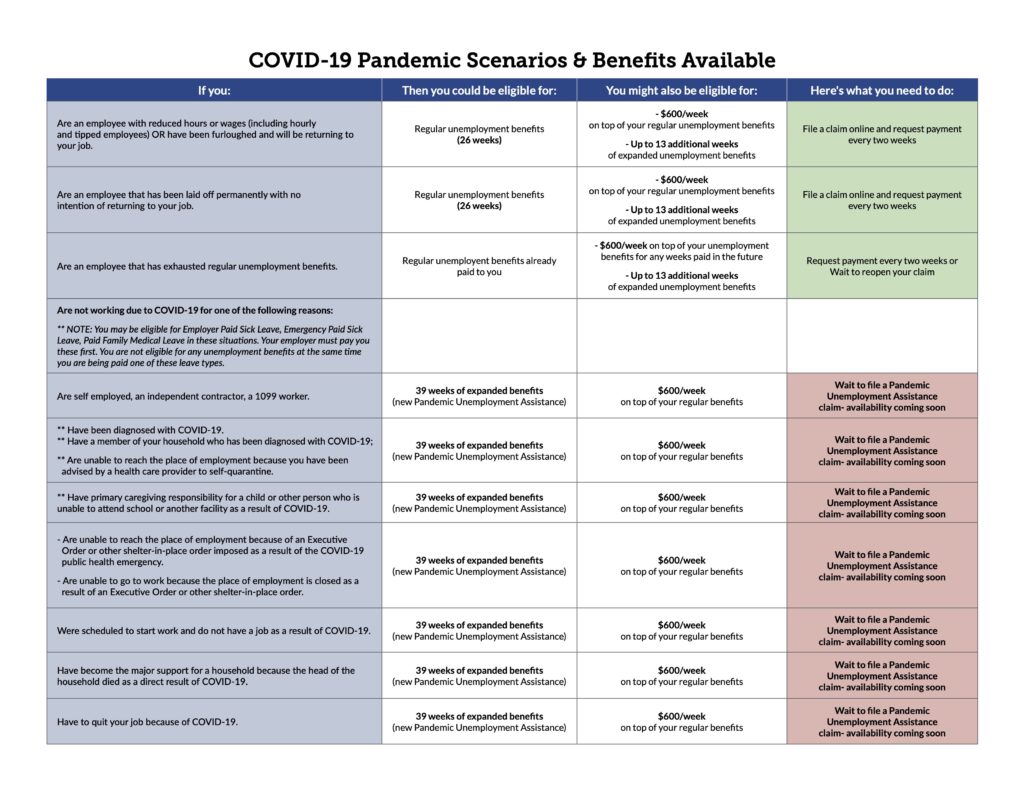

In june and july 2020, colorado enacted legislation, promulgated a regulation and issued administrative guidance, all as part of an effort to address the state’s conformity to the internal revenue code (irc) and the federal cares act. Extends the additional payment of $300/week through september 6, 2021 extends pua and peuc until september 6, 2021 (it extends an individual’s eligibility to collect pua benefits from 50 to 79 weeks and to collect peuc from. Cares act for colorado realtors®. In march 2020, the coronavirus aid, relief, and economic security (cares) act was enacted, and in december 2020, the coronavirus response and relief supplemental appropriations act provided an additional $900 billion in funding for education. Access to small business loans for nonprofits with.

.jpg?h=a6c62273 “Colorado CARES Act Grant Colorado Office of Economic”) Source: oedit.colorado.gov

And (2) the amount the taxpayer was required to add back due to colorado decoupling from the cares act changes to irc section. Colorado college was the recipient of federal funding under the coronavirus aid, relief, and economic security act, also known as the cares act, which provides emergency relief funds to organizations and individuals affected by the coronavirus pandemic. Information on the education funding streams from these stimulus bills is provided on this page: Learn how the federal coronavirus relief bill, also known as the cares act, may affect you and your charitable goals in this prerecorded. Office of housing finance & sustainability.

Source: ferqmy.blogspot.com

Source: ferqmy.blogspot.com

Corona virus relief fund cvrf guidance faq process flowchart cdola.colorado.gov/cvrf. Section 199a provided by the cares act Information on the education funding streams from these stimulus bills is provided on this page: Tax benefits of the cares act: The act is in response to the federal cares act impact to colorado, including impacts to the:

Source: coloradohealthinstitute.org

Source: coloradohealthinstitute.org

On behalf of the national endowment for the arts, colorado creative industries (cci) awarded funds to nonprofit arts organizations in colorado to help these entities and their employees. Section 163(j) deduction for qualified business income under i.r.c. On march 27, 2020, the president of the united states signed the coronavirus aid, relief, and economic security act, also known as the cares act (h.r. Access to small business loans for nonprofits with. “guidance will come,” says chris lamay.

Source: missiontrust.com

Source: missiontrust.com

(1) the amount that application of the retroactive provisions of the cares act would have reduced a taxpayer’s colorado taxable income for each tax year ending before march 27, 2020; Special eviction prevention task force; Polis directed the transfer of $510 million from the state of colorado’s cares act coronavirus relief fund to cde to be. Section 163(j) deduction for qualified business income under i.r.c. Cares act for colorado realtors®.

Source: coloradokids.org

Source: coloradokids.org

On behalf of the national endowment for the arts, colorado creative industries (cci) awarded funds to nonprofit arts organizations in colorado to help these entities and their employees. Access to small business loans for nonprofits with. (digital version available.) the higher education emergency relief fund. The cares act provides funds to institutions of higher education to provide students with emergency financial aid grants to help cover expenses related to the disruption of university operations due to coronavirus. Office of housing finance & sustainability.

Source: in.pinterest.com

Source: in.pinterest.com

The president signed the coronavirus aid, relief, and economic security act (cares act) on march 27. Contractor & partner agencies resources. Learn how the federal coronavirus relief bill, also known as the cares act, may affect you and your charitable goals in this prerecorded. The university of northern colorado will distribute $3,825,107 in cares act funding in a way that prioritizes eligible students with the greatest demonstrated need and ensures that funds are distributed as widely as possible. The cares act provides funds to institutions of higher education to provide students with emergency financial aid grants to help cover expenses related to the disruption of university operations due to coronavirus.

Source: pod.co

Source: pod.co

The president signed the coronavirus aid, relief, and economic security act (cares act) on march 27. Excess business loss deduction under i.r.c. Tax benefits of the cares act: “guidance will come,” says chris lamay. 1 for many taxpayers, the required state addbacks resulted in a permanent disallowance of certain deductions.

Source: skrco.com

Source: skrco.com

The university of colorado denver | anschutz signed and returned the department of education’s certification and agreement acknowledging that the university will use 50 percent of the total funds received under section 18004(a)(1) of the cares act to provide emergency financial aid grants to students. The coronavirus aid, relief, and economic security act, also known as the cares act, is a $2.2 trillion economic stimulus bill passed by the 116th u.s. A visualization of the types of funding with definitions and intended benefits. The university of colorado denver | anschutz signed and returned the department of education’s certification and agreement acknowledging that the university will use 50 percent of the total funds received under section 18004(a)(1) of the cares act to provide emergency financial aid grants to students. Below is our reaction to and summary of the legislation.

Source: colorxml.com

Source: colorxml.com

Cares act ii inches closer as 280,000 coloradans will lose unemployment benefits day after christmas. And (2) the amount the taxpayer was required to add back due to colorado decoupling from the cares act changes to irc section. In short, the deduction is calculated by adding up the following: Section 163(j) deduction for qualified business income under i.r.c. Colorado creates cares act modifications.

Source: red.msudenver.edu

Source: red.msudenver.edu

Section 461(i) deduction for business interest expense under i.r.c. The cares act doesn’t reimburse schools for as broad a variety of expenses. Cares act tax law changes & colorado impact 3 revised august 2021 individuals6 net operating losses net operating loss carryback provisions the cares act allowed taxpayers to carry back net operating losses arising in tax years beginning after december 31, 2017 and before january 1, 2021 to the five tax years preceding the year of the loss.7 The act is in response to the federal cares act impact to colorado, including impacts to the: The university of northern colorado will distribute $3,825,107 in cares act funding in a way that prioritizes eligible students with the greatest demonstrated need and ensures that funds are distributed as widely as possible.

Source: colorxml.com

Source: colorxml.com

On behalf of the national endowment for the arts, colorado creative industries (cci) awarded funds to nonprofit arts organizations in colorado to help these entities and their employees. Contractor & partner agencies resources. The total amount of the funds that colorado mesa university will receive pursuant to the certification and agreement is $12,116,155 of which $3,534,190 is to be utilized for emergency. Corona virus relief fund cvrf guidance faq process flowchart cdola.colorado.gov/cvrf. The coronavirus aid, relief, and economic security act, also known as the cares act, is a $2.2 trillion economic stimulus bill passed by the 116th u.s.

Source: blog.jmdenverhomes.com

Source: blog.jmdenverhomes.com

Excess business loss deduction under i.r.c. Students of all abilities made substantial progress in cores across the year. The act is in response to the federal cares act impact to colorado, including impacts to the: The coronavirus aid, relief, and economic security act, also known as the cares act, is a $2.2 trillion economic stimulus bill passed by the 116th u.s. On behalf of the national endowment for the arts, colorado creative industries (cci) awarded funds to nonprofit arts organizations in colorado to help these entities and their employees.

Source: connect2local.com

Source: connect2local.com

Colorado cares act rent assistance. The coronavirus aid, relief, and economic security act, also known as the cares act, is a $2.2 trillion economic stimulus bill passed by the 116th u.s. Section 199a provided by the cares act The university of colorado denver | anschutz signed and returned the department of education’s certification and agreement acknowledging that the university will use 50 percent of the total funds received under section 18004(a)(1) of the cares act to provide emergency financial aid grants to students. Learn how the federal coronavirus relief bill, also known as the cares act, may affect you and your charitable goals in this prerecorded.

Source: rem-co.com

Source: rem-co.com

The president signed the coronavirus aid, relief, and economic security act (cares act) on march 27. Cares act ii inches closer as 280,000 coloradans will lose unemployment benefits day after christmas. Contractor & partner agencies resources. The university of northern colorado will distribute $3,825,107 in cares act funding in a way that prioritizes eligible students with the greatest demonstrated need and ensures that funds are distributed as widely as possible. As a renter or as a landlord, government programs can help you with rent money and advice for your situation.

Source: koaa.com

Source: koaa.com

“guidance will come,” says chris lamay. A visualization of the types of funding with definitions and intended benefits. (digital version available.) the higher education emergency relief fund. 1 for many taxpayers, the required state addbacks resulted in a permanent disallowance of certain deductions. Colorado cares act rent assistance.

Source: slideserve.com

Source: slideserve.com

21, 2021, colorado enacted legislation, h.b. The president signed the coronavirus aid, relief, and economic security act (cares act) on march 27. Dola will share as they know more. Excess business loss deduction under i.r.c. On march 27, 2020, the president of the united states signed the coronavirus aid, relief, and economic security act, also known as the cares act (h.r.

Source: kgw.com

Source: kgw.com

Excess business loss deduction under i.r.c. The cares act expired at the end of 2020. Cares act tax law changes & colorado impact 3 revised august 2021 individuals6 net operating losses net operating loss carryback provisions the cares act allowed taxpayers to carry back net operating losses arising in tax years beginning after december 31, 2017 and before january 1, 2021 to the five tax years preceding the year of the loss.7 The cares act doesn’t reimburse schools for as broad a variety of expenses. The university of colorado denver | anschutz signed and returned the department of education’s certification and agreement acknowledging that the university will use 50 percent of the total funds received under section 18004(a)(1) of the cares act to provide emergency financial aid grants to students.

This site is an open community for users to do submittion their favorite wallpapers on the internet, all images or pictures in this website are for personal wallpaper use only, it is stricly prohibited to use this wallpaper for commercial purposes, if you are the author and find this image is shared without your permission, please kindly raise a DMCA report to Us.

If you find this site serviceableness, please support us by sharing this posts to your favorite social media accounts like Facebook, Instagram and so on or you can also save this blog page with the title cares act colorado by using Ctrl + D for devices a laptop with a Windows operating system or Command + D for laptops with an Apple operating system. If you use a smartphone, you can also use the drawer menu of the browser you are using. Whether it’s a Windows, Mac, iOS or Android operating system, you will still be able to bookmark this website.

Category

Related By Category

- Car rental plattsburgh ny information

- Car window tinting prices near me Idea

- Car rental bluffton sc Idea

- Car wash scottsdale information

- Cars strip weathers Idea

- Car rental ithaca ny information

- Care 4 kids information

- Car jack rental Idea

- Centerville family eye care information

- Car towing information