Car lease money factor Idea

Home » Trend » Car lease money factor IdeaYour Car lease money factor images are ready. Car lease money factor are a topic that is being searched for and liked by netizens today. You can Get the Car lease money factor files here. Get all royalty-free vectors.

If you’re searching for car lease money factor pictures information linked to the car lease money factor topic, you have pay a visit to the ideal site. Our site always gives you hints for seeing the maximum quality video and picture content, please kindly hunt and locate more informative video content and graphics that match your interests.

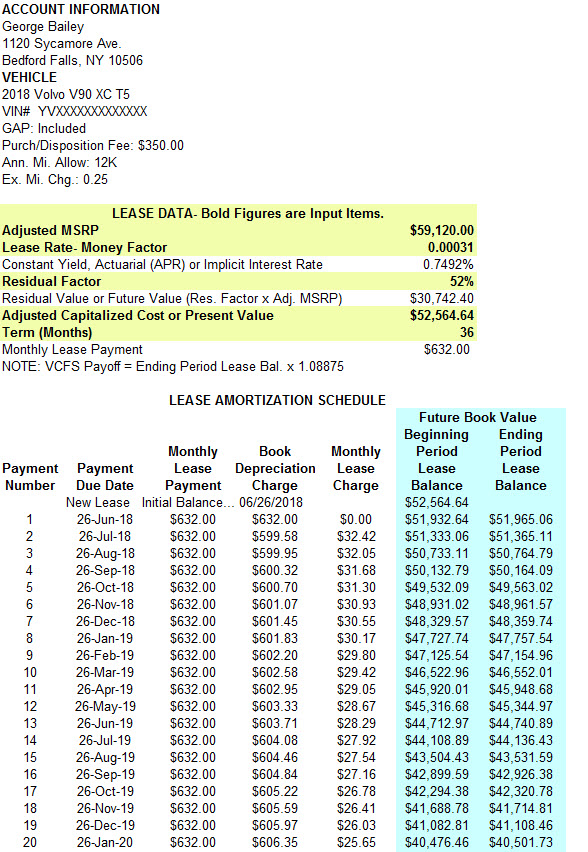

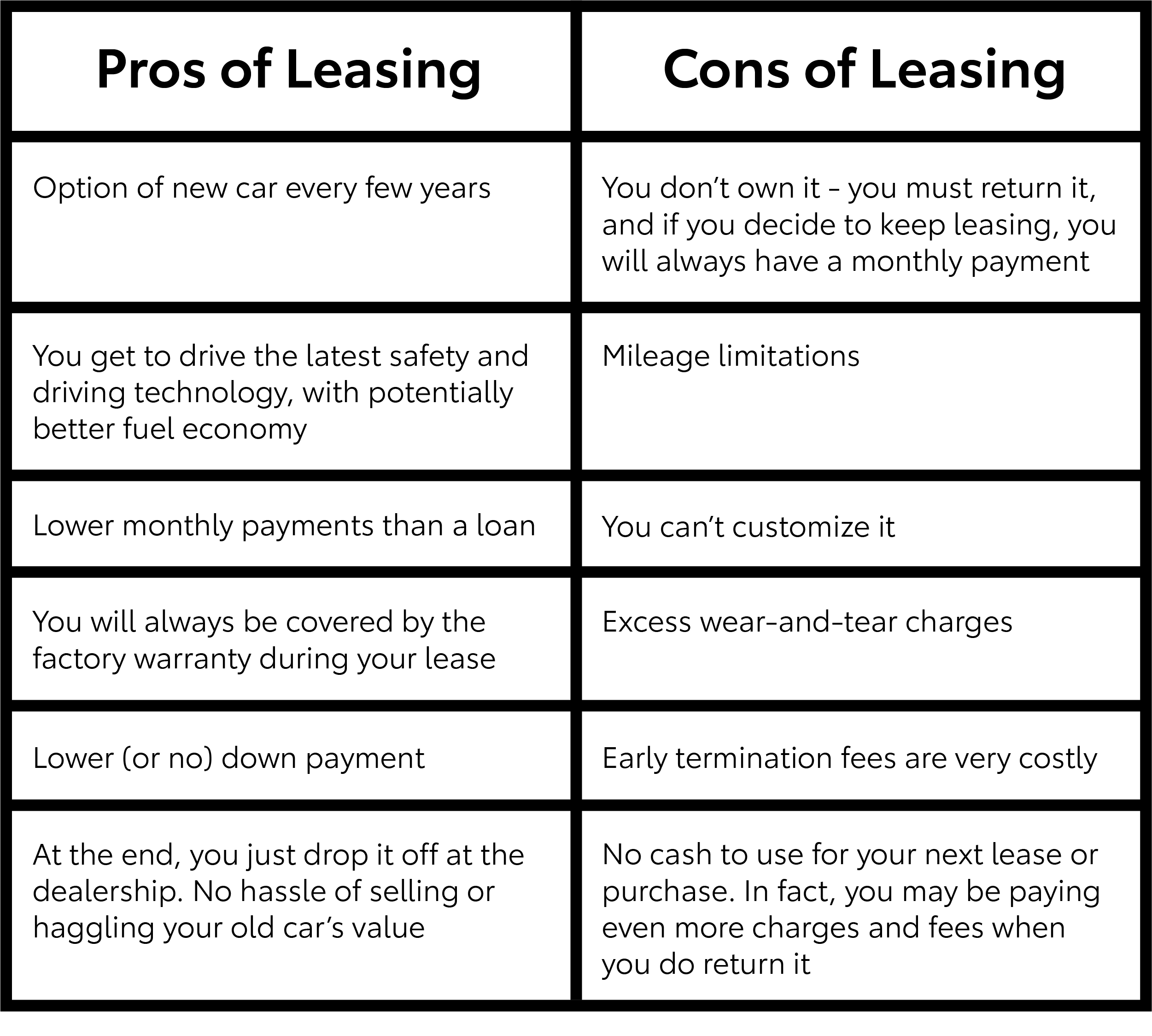

Car Lease Money Factor. The money factor is basically the interest rate you are leasing the car for. The money factor is basically the interest rate you are leasing the car for. Strictly speaking, the term “money factor” refers to the interest rate on a car lease, but it isn’t expressed in the same way. They generally work very similarly:

2015 Bmw X5 Lease Money Factor more picture 2015 Bmw X5 From pinterest.com

2015 Bmw X5 Lease Money Factor more picture 2015 Bmw X5 From pinterest.com

To see your annual percentage rate (apr), you multiply it by 2,400. This number, also called the lease factor, is the interest rate used in calculating your monthly payments. The money factor on a lease is almost always written using an extremely small decimal, such as 0.00167 — and that’s when it’s written at all. It is easy to determine the money factor’s internet rate equivalent by multiplying it by 2400. As you can assume from the name, this method only comes into play when you are considering leasing a vehicle, not with a retail purchase. During the term of the lease, some of the car’s value has been consumed.

Money factor calculator since lessors and dealers don’t need to publish the money factor as part of advertising a lease or even presenting a custom lease quote this information is often not shared.

Net cap cost, cap cost reductions, residual, money factor, and term (see how leasing works).). Imagine if you want to do a bmw x7 lease and the car dealer starts mentioning the things like bmw lease money factor.you might end up making the conversation short and sign a deal that will surprise you. As you can assume from the name, this method only comes into play when you are considering leasing a vehicle, not with a retail purchase. Conceptually, a car lease isn’t very different than buying a car and selling it at the end of the agreement’s term. The lease rate factor has a money factor instead of an interest rate, whereas an interest rate factor has a percentage rate of interest, which is calculated annually. Money factor = $5,500 / $1,980,000.

Source: youtube.com

Source: youtube.com

Now, let’s put it all together and see exactly how a monthly lease payment is calculated. ($20,000 + $13,110) x 0.00125 = $41.39. A money factor may also be presented as a factor of 1,000, such as 2.0 rather. Molly baxter(@mollybaxter_cars), naam wynn(@naamwynn), molly baxter(@mollybaxter_cars), molly baxter(@mollybaxter_cars), zach sherman(@ztsherman). For instance, if you have a money factor of 0.0021, after multiplying it by 2400, you get 5.04.

Source: youtube.com

Source: youtube.com

The money factor is just an elegant word for interest. They generally work very similarly: To see your annual percentage rate (apr), you multiply it by 2,400. And delivers the consumer with a measure of the funding cost associated with a lease. In auto leasing, the interest rate is expressed differently.

Source: mathscinotes.wordpress.com

Source: mathscinotes.wordpress.com

In this example, the equipment has a net capital cost of $120,000 and a residual value of $30,000 at the end of the lease. What is the money factor? Conceptually, a car lease isn’t very different than buying a car and selling it at the end of the agreement’s term. The definitive lease calculator loved by the largest car leasing community in the us. So, if you’re offered a money factor of.004, you can see that it will translate to an interest rate of 10 percent.

Source: youtube.com

Source: youtube.com

In this example, the equipment has a net capital cost of $120,000 and a residual value of $30,000 at the end of the lease. Money factor is not quite same as the internet rate. Money factor is calculated by taking the actual bank interest rate of the loan and dividing it by 2400, resulting in a decimal based number. Lmf = lease money factor. The money factor is basically the interest rate you are leasing the car for.

Source: smartmotorist.com

Source: smartmotorist.com

Money factor = $5,500 / ($34,000+$21,000) x 36 months. 0017 is a good deal. To convert a money factor into a simple interest rate, multiply it by 2,400. Money factor car lease 1.2m views discover short videos related to money factor car lease on tiktok. The definitive lease calculator loved by the largest car leasing community in the us.

Source: chegg.com

Source: chegg.com

The poorer the credit history of the lessee, the higher their money factor, and the. The money factor on a lease is almost always written using an extremely small decimal, such as 0.00167 — and that’s when it’s written at all. Lease factors can, at times, make very costly. A higher money factor means your lease payments will be high too. The money factor is the financing charge a person will pay on a lease.

Source: mymarilynyear.blogspot.com

Source: mymarilynyear.blogspot.com

Now, let’s put it all together and see exactly how a monthly lease payment is calculated. Lease factors can, at times, make very costly. In auto leasing, the interest rate is expressed differently. Lmf = 18,000/ ( (120,000 + 30,000. A money factor, or sometimes better known as a “lease factor” or “lease fee,” is a different method of showcasing the amount of interest charged on a lease with monthly payments.

Source: mymarilynyear.blogspot.com

Source: mymarilynyear.blogspot.com

A lease deal with a money factor of less than. A money factor is going to be expressed as a decimal, such as “0.0056.”. As you can assume from the name, this method only comes into play when you are considering leasing a vehicle, not with a retail purchase. This number, also called the lease factor, is the interest rate used in calculating your monthly payments. A money factor, or sometimes better known as a “lease factor” or “lease fee,” is a different method of showcasing the amount of interest charged on a lease with monthly payments.

Source: edmunds.com

Source: edmunds.com

What is the money factor? In auto leasing, the interest rate is expressed differently. The total monthly fees are $5,500. 0017 is a good deal. 0017 (divide interest rate by 2400).

Source: autotrader.com

Source: autotrader.com

Molly baxter(@mollybaxter_cars), naam wynn(@naamwynn), molly baxter(@mollybaxter_cars), molly baxter(@mollybaxter_cars), zach sherman(@ztsherman). 0017 (divide interest rate by 2400). A money factor, or sometimes better known as a “lease factor” or “lease fee,” is a different method of showcasing the amount of interest charged on a lease with monthly payments. Sometimes the dealership will try to tell you interest rates are not part of auto leasing, but that is wrong. The lease�s term is for 60 monthly payments with a lease charge of $18,000.

Source: pinterest.com

Source: pinterest.com

A money factor is going to be expressed as a decimal, such as “0.0056.”. Here is what that would look like, using our money factor of 0.00125. Lease factors can, at times, make very costly. The money factor is basically the interest rate you are leasing the car for. Car leases and the money factor.

Source: youtube.com

Source: youtube.com

Money factor calculator since lessors and dealers don’t need to publish the money factor as part of advertising a lease or even presenting a custom lease quote this information is often not shared. The money factor in a car lease is always determined by a customer’s credit score. At any time when we want to convert the money factor or lease rate factor to interest rate, we need to multiply the same with 2400. Imagine if you want to do a bmw x7 lease and the car dealer starts mentioning the things like bmw lease money factor.you might end up making the conversation short and sign a deal that will surprise you. For instance, if you have a money factor of 0.0021, after multiplying it by 2400, you get 5.04.

Source: forums.edmunds.com

Source: forums.edmunds.com

P = number of payments during lease term. So, if you’re offered a money factor of.004, you can see that it will translate to an interest rate of 10 percent. ($20,000 + $13,110) x 0.00125 = $41.39. Watch popular content from the following creators: During the term of the lease, some of the car’s value has been consumed.

Source: endurancewarranty.com

Source: endurancewarranty.com

Money factor = $5,500 / $1,980,000. The lingo might confuse you. Money factor calculator since lessors and dealers don’t need to publish the money factor as part of advertising a lease or even presenting a custom lease quote this information is often not shared. Money factor is calculated by taking the actual bank interest rate of the loan and dividing it by 2400, resulting in a decimal based number. Money factor is calculated by taking the actual bank interest rate of the loan and dividing it by 2400, resulting in a decimal based number.

Source: edmunds.com

Source: edmunds.com

In this example, the equipment has a net capital cost of $120,000 and a residual value of $30,000 at the end of the lease. In auto leasing, the interest rate is expressed differently. Now, let’s put it all together and see exactly how a monthly lease payment is calculated. Money factor—this is the interest rate expressed differently and used specifically in the context of car leases. Lessors use the money factor as a way to determine lease rates that correspond to each lessee�s credit history.

Source: thefinancetwins.com

Source: thefinancetwins.com

It is easy to determine the money factor’s internet rate equivalent by multiplying it by 2400. P = number of payments during lease term. A money factor may also be presented as a factor of 1,000, such as 2.0 rather. Conceptually, a car lease isn’t very different than buying a car and selling it at the end of the agreement’s term. The total monthly fees are $5,500.

Source: emo-cionalesondas.blogspot.com

Source: emo-cionalesondas.blogspot.com

Here is what that would look like, using our money factor of 0.00125. In this example, the equipment has a net capital cost of $120,000 and a residual value of $30,000 at the end of the lease. P = number of payments during lease term. So, if you’re offered a money factor of.004, you can see that it will translate to an interest rate of 10 percent. Money factor is not quite same as the internet rate.

Source: emilly-rayanni.blogspot.com

A higher money factor means your lease payments will be high too. A lease with a.0056 money factor has an apr of 13.44%. Here is what that would look like, using our money factor of 0.00125. We’ve already discussed the separate factors that contribute to the cost of car leasing: The car lease term is three years, or 36 months, with an estimated residual value of $21,00.

This site is an open community for users to do submittion their favorite wallpapers on the internet, all images or pictures in this website are for personal wallpaper use only, it is stricly prohibited to use this wallpaper for commercial purposes, if you are the author and find this image is shared without your permission, please kindly raise a DMCA report to Us.

If you find this site helpful, please support us by sharing this posts to your preference social media accounts like Facebook, Instagram and so on or you can also save this blog page with the title car lease money factor by using Ctrl + D for devices a laptop with a Windows operating system or Command + D for laptops with an Apple operating system. If you use a smartphone, you can also use the drawer menu of the browser you are using. Whether it’s a Windows, Mac, iOS or Android operating system, you will still be able to bookmark this website.

Category

Related By Category

- Car rental plattsburgh ny information

- Car window tinting prices near me Idea

- Car rental bluffton sc Idea

- Car wash scottsdale information

- Cars strip weathers Idea

- Car rental ithaca ny information

- Care 4 kids information

- Car jack rental Idea

- Centerville family eye care information

- Car towing information