Car excise tax ma information

Home » Trending » Car excise tax ma informationYour Car excise tax ma images are available in this site. Car excise tax ma are a topic that is being searched for and liked by netizens today. You can Get the Car excise tax ma files here. Find and Download all royalty-free photos.

If you’re looking for car excise tax ma pictures information connected with to the car excise tax ma topic, you have pay a visit to the ideal site. Our site always gives you suggestions for seeking the maximum quality video and image content, please kindly surf and find more enlightening video content and graphics that fit your interests.

Car Excise Tax Ma. The excise is levied by the city or town where the vehicle is principally garaged and the revenues become part of the local community treasury. A motor vehicle excise tax is imposed on every motor vehicle and trailer registered in massachusetts. Every motor vehicle and trailer registered in massachusetts is subject to excise tax unless expressly exempted. Under mgl chapter 60a all massachusetts residents who own and register a motor vehicle must annually pay a motor vehicle excise tax.

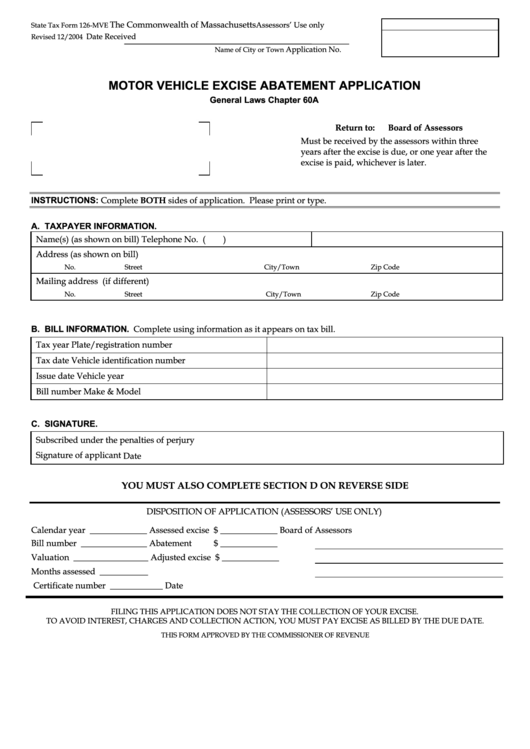

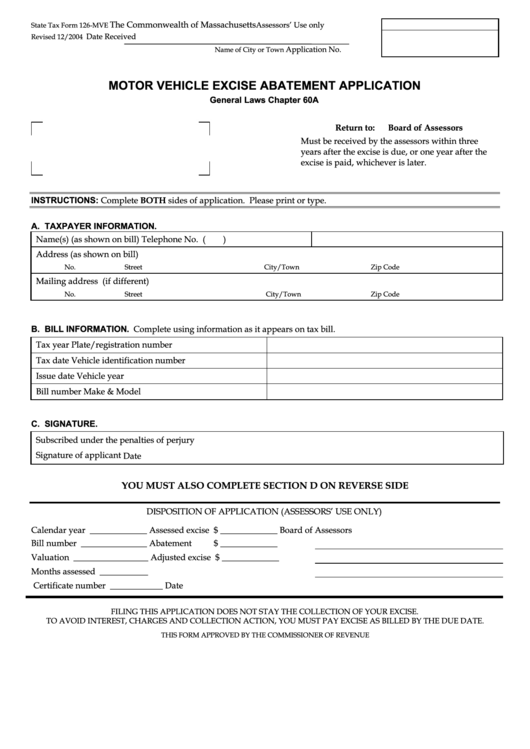

Fillable Form 126Mve Motor Vehicle Excise Abatement From formsbank.com

Fillable Form 126Mve Motor Vehicle Excise Abatement From formsbank.com

Motor vehicle excise tax is assessed and levied each calendar year for every motor vehicle that is registered in the commonwealth of massachusetts. Also, under mgl chapter 59 section 2 it is important to note that every motor vehicle, whether registered or not, is subject to taxation, either as excise or personal property, for the privilege of road use, whether actual or future. It is charged for a full calendar year and billed by the community where the vehicle is usually garaged. The excise is levied annually in lieu of a tangible personal property tax. Excise tax bills are prepared by the registry of motor vehicles and billed by the local community where the vehicle is garaged. The tax rate is fixed at $25 per one thousand dollars of value.

Deputy collector of taxes, p.o.

It is prorated by the month, so whether a vehicle is registered at the beginning or end of the month, the billing starts with that full month. Chapter 60a imposes an excise on the privilege of registering a motor vehicle or a trailer in the commonwealth of massachusetts. The tax is imposed for the privilege of using the roadways and for registering a motor vehicle. The excise is levied annually in lieu of a tangible personal property tax. It is an annual tax for the privilege of registration. All massachusetts residents who own and register a motor vehicle must annually pay a motor vehicle excise.

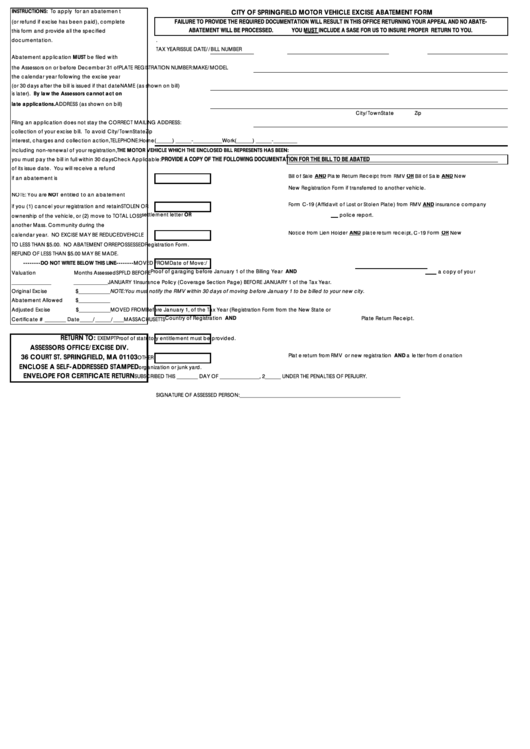

Source: formsbank.com

Source: formsbank.com

The excise rate is $25 per $1,000 of your vehicle�s value. Since 1981, the massachusetts registry of motor vehicles (rmv) calculates the value of vehicles for the excise tax at a rate of $25 per $1,000 based on the value of the vehicle according to a depreciation schedule. Chapter 60a imposes an excise on the privilege of registering a motor vehicle or a trailer in the commonwealth of massachusetts. Motor vehicle excise tax about. The tax is calculated from the date of registration to the end of the calendar year.

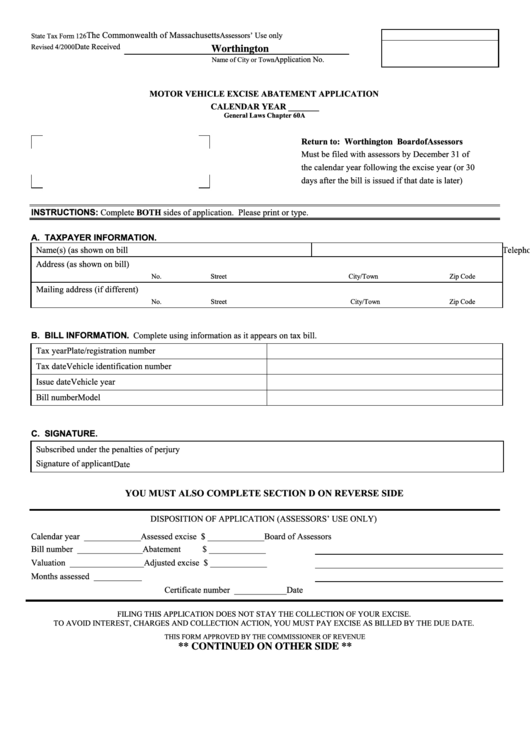

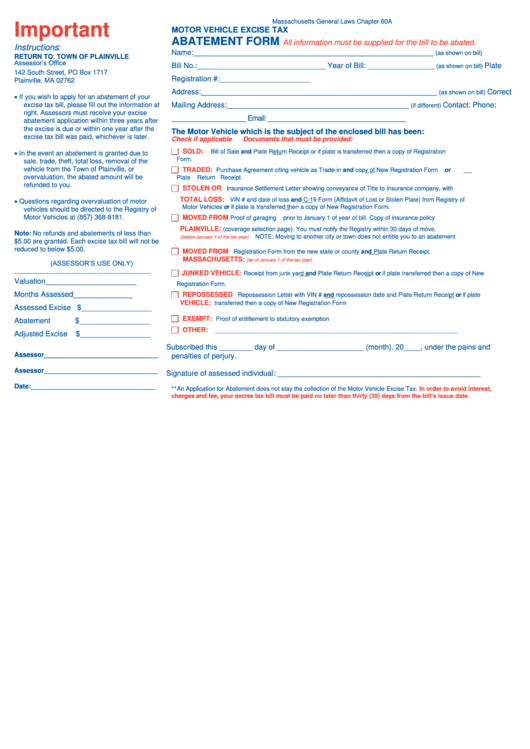

Source: uslegalforms.com

Source: uslegalforms.com

The minimum an excise bill may be is $5.00. Excise tax bills are prepared by the registry of motor vehicles and billed by the local community where the vehicle is garaged. If your vehicle is registered in massachusetts but garaged outside of massachusetts, the commissioner of revenue will bill the excise. The excise is levied by the city or town where the vehicle is principally garaged and the revenues become part of the local community treasury. Masstaxconnect log in to file and pay taxes.

Source: franklinmatters.org

Source: franklinmatters.org

The city or town where the vehicle is principally garaged levies the excise annually. Chapter 60a of massachusetts general laws imposes an excise on the privilege of registering a motor vehicle or a trailer in the commonwealth of massachusetts. The minimum an excise bill may be is $5.00. The excise is levied annually in lieu of a tangible personal property tax. Excise bills are prepared by the registry of motor vehicles according to the.

Source: aamantrandesigns.blogspot.com

The tax rate for motor vehicle excise tax is $25 per thousand of value. A motor vehicle excise tax is imposed on every motor vehicle and trailer registered in massachusetts. Motor vehicle excise tax bills are due in 30 days. Motor vehicle excise is taxed on the calendar year. The tax is imposed for the privilege of using the roadways and for registering a motor vehicle.

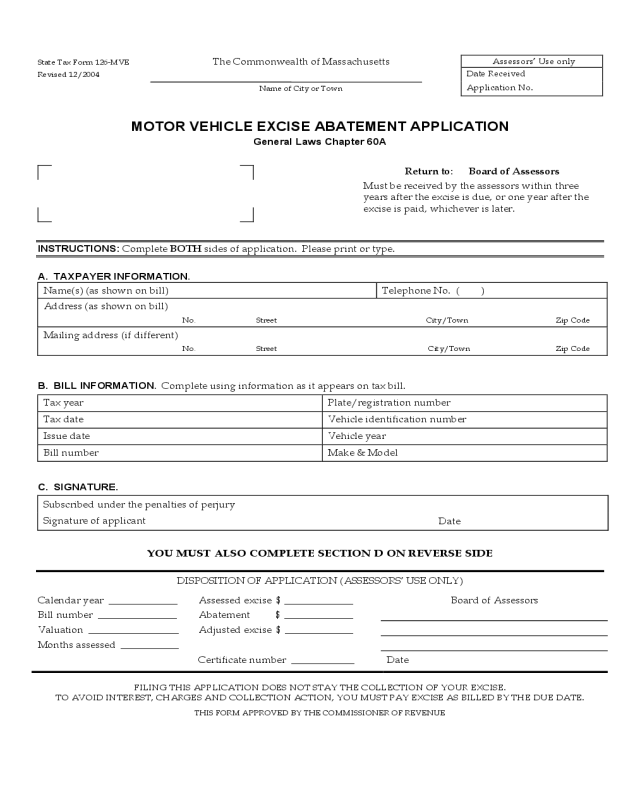

Source: formsbank.com

Source: formsbank.com

The excise is levied annually in lieu of a tangible personal property tax. Deputy collector of taxes, p.o. It is an assessment in lieu of a personal property tax. The registration process automatically triggers the assessment of the excise by the registry of motor vehicles (rmv). Registering a motor vehicle automatically triggers an excise tax.

Excise bills are prepared by the registry of motor vehicles according to the. The tax is imposed for the privilege of using the roadways and for registering a motor vehicle. You need to pay the bill within 30 days of the date we issued the bill. It is charged for a full calendar year and billed by the community where the vehicle is usually garaged. The registration process automatically triggers the assessment of the excise by the registry of motor vehicles (rmv).

Source: fill.io

Source: fill.io

If your vehicle isn�t registered, you’ll have to pay personal property taxes on it. Motor vehicle excise tax is an annual tax for the privilege of registering a motor vehicle or trailer. Chapter 60a imposes an excise on the privilege of registering a motor vehicle or a trailer in the commonwealth of massachusetts. The value of a vehicle is determined as a percentage of the manufacturer�s. The informational data, as it appears on.

Source: formsbirds.com

Source: formsbirds.com

The excise is levied annually in lieu of a tangible personal property tax. The excise is levied by the city or town where the vehicle is principally garaged and the revenues become part of the local community treasury. The vehicle excise tax deduction is a federal item, and is specifically reported to the irs on form 1040, schedule a, line 7 (please see the attached image at. The excise rate is $25 per $1,000 of your vehicle�s value. Chapter 60a imposes an excise on the privilege of registering a motor vehicle or a trailer in the commonwealth of massachusetts.

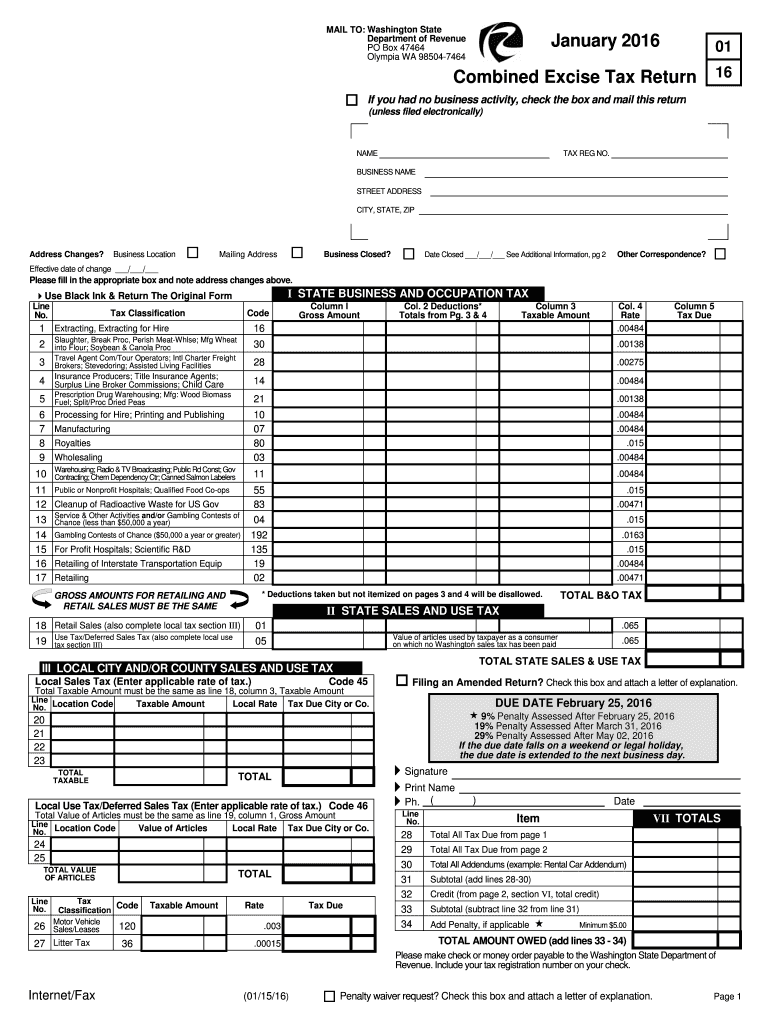

Source: taxf.blogspot.com

Source: taxf.blogspot.com

You pay an excise instead of a personal property tax. The tax rate is fixed at $25 per one thousand dollars of value. The motor vehicle excise tax is imposed on every motor vehicle and trailer registered in massachusetts. Motor vehicle excise tax is an annual tax for the privilege of registering a motor vehicle or trailer. You pay an excise instead of a personal property tax.

Source: patch.com

Source: patch.com

It is charged for a full calendar year and billed by the community where the vehicle is usually garaged. The city or town where the vehicle is principally garaged levies the excise annually. The excise is levied by the city or town where the vehicle is principally garaged and the revenues become part of the local community treasury. The excise is levied annually in lieu of a tangible personal property tax. It is charged for a full calendar year and billed by the community where the vehicle is usually garaged.

Source: formsbank.com

Source: formsbank.com

Under mgl chapter 60a all massachusetts residents who own and register a motor vehicle must annually pay a motor vehicle excise tax. The state’s registry of motor vehicles determines the value of motor vehicles. It is an assessment in lieu of a personal property tax. The excise due is calculated by multiplying the value of the vehicle by the motor vehicle tax rate. The tax rate for motor vehicle excise tax is $25 per thousand of value.

Masstaxconnect log in to file and pay taxes. Chapter 60a of massachusetts general laws imposes an excise for the privilege of registering a motor vehicle or a trailer on the commonwealth of massachusetts. The percentage of the value is based as follows: Payments are considered made when received by the collector. All massachusetts residents who own and register a motor vehicle must annually pay a motor vehicle excise.

Source: taxwalls.blogspot.com

Source: taxwalls.blogspot.com

You pay an excise instead of a personal property tax. You pay an excise instead of a personal property tax. The registration process automatically triggers the assessment of the excise by the registry of motor vehicles (rmv). It is charged for a full calendar year and billed by the community where the vehicle is usually garaged. Chapter 60a of massachusetts general laws imposes an excise on the privilege of registering a motor vehicle or a trailer in the commonwealth of massachusetts.

Source: bellinghamautoacservice.com

Source: bellinghamautoacservice.com

The excise is levied annually in lieu of a tangible personal property tax. If a motor vehicle owner moves within massachusetts and has not paid an excise tax for the current year, he / she should immediately notify the local assessor of his/her new address. The tax is imposed for the privilege of using the roadways and for registering a motor vehicle. We send you a bill in the mail. The excise is levied annually in lieu of a tangible personal property tax.

Source: fill.io

Source: fill.io

The vehicle excise tax deduction is a federal item, and is specifically reported to the irs on form 1040, schedule a, line 7 (please see the attached image at. Chapter 60a imposes an excise on the privilege of registering a motor vehicle or a trailer in the commonwealth of massachusetts. Motor vehicle excise is taxed on the calendar year. Excise tax bills are prepared by the registry of motor vehicles and billed by the local community where the vehicle is garaged. The percentage of the value is based as follows:

Source: formsbank.com

Source: formsbank.com

The excise is levied annually in lieu of a tangible personal property tax. The excise is levied annually in lieu of a tangible personal property tax. It is an annual tax for the privilege of registration. Chapter 60a imposes an excise on the privilege of registering a motor vehicle or a trailer in the commonwealth of massachusetts. The excise is levied annually in lieu of a tangible personal property tax.

Source: fpdesignarchive.blogspot.com

Source: fpdesignarchive.blogspot.com

Excise tax bills are prepared by the registry of motor vehicles and billed by the local community where the vehicle is garaged. Masstaxconnect log in to file and pay taxes. The value of a vehicle is determined as a percentage of the manufacturer�s. Motor vehicle excise tax all massachusetts residents who own and register a motor vehicle in the state must pay a motor vehicle excise tax. You need to pay the bill within 30 days of the date we issued the bill.

Source: handypdf.com

Source: handypdf.com

The tax rate for motor vehicle excise tax is $25 per thousand of value. The city or town where the vehicle is principally garaged levies the excise annually. Chapter 60a imposes an excise on the privilege of registering a motor vehicle or a trailer in the commonwealth of massachusetts. Motor vehicle excise tax all massachusetts residents who own and register a motor vehicle in the state must pay a motor vehicle excise tax. Chapter 60a of massachusetts general laws imposes an excise for the privilege of registering a motor vehicle or a trailer on the commonwealth of massachusetts.

This site is an open community for users to do sharing their favorite wallpapers on the internet, all images or pictures in this website are for personal wallpaper use only, it is stricly prohibited to use this wallpaper for commercial purposes, if you are the author and find this image is shared without your permission, please kindly raise a DMCA report to Us.

If you find this site beneficial, please support us by sharing this posts to your favorite social media accounts like Facebook, Instagram and so on or you can also bookmark this blog page with the title car excise tax ma by using Ctrl + D for devices a laptop with a Windows operating system or Command + D for laptops with an Apple operating system. If you use a smartphone, you can also use the drawer menu of the browser you are using. Whether it’s a Windows, Mac, iOS or Android operating system, you will still be able to bookmark this website.

Category

Related By Category

- Car rocker Idea

- Cars for sale myrtle beach information

- Care now fort pierce Idea

- Careen meaning Idea

- Careworks urgent care information

- Car rental statesboro ga information

- Car sense hatfield pa Idea

- Car rental owensboro ky Idea

- Car not blowing hot air information

- Car names that start with c information